Super sector moves on emissions, as funds commit to net zero

Superannuation is an influential component of Australia’s economy and a significant and growing source of investment in domestic assets. Within the next 20 years, superfunds could dominate domestic shareholdings, with collective ownership of up to 60 per cent of shares in the Australian Securities Exchange (ASX) (Deloitte 2019).

The long-term investment horizons of superannuation funds make them acutely vulnerable to the systemic disruptions associated with climate change. As investors in Australia’s largest companies, including big corporate emitters, superannuation funds can play an important role in Australia’s economic decarbonisation (PRI 2020a).

There are indications this sector is starting to transition. Conscious of the commercial implications of climate risks and of regulatory, legislative and policy requirements for action, institutional investors are acting to address the likely impacts of global warming. Under pressure from regulators and customers, many are emphasising engagement activities, such as asking the companies in which they invest to disclose – and, in some cases, address – their climate risks. Superannuation funds are themselves making commitments to reduce emissions funded through their investment portfolios, a further sign of gathering momentum for change.

Much more, however, remains to be done.

This Superannuation Sector report highlights the actions of 20 Australian superannuation organisations, and the commitments they have made to address emissions funded through their investments. It evaluates their alignment with the goal of net zero emissions by 2050, a key element of the Paris Agreement. The analysis focuses on the largest Registrable Superannuation Entity Licensees, based on the value of assets under management (APRA 2019).

It finds that, despite the economic repercussions of the COVID-19 pandemic, efforts by Australian superannuation funds to address climate change risks are accelerating.

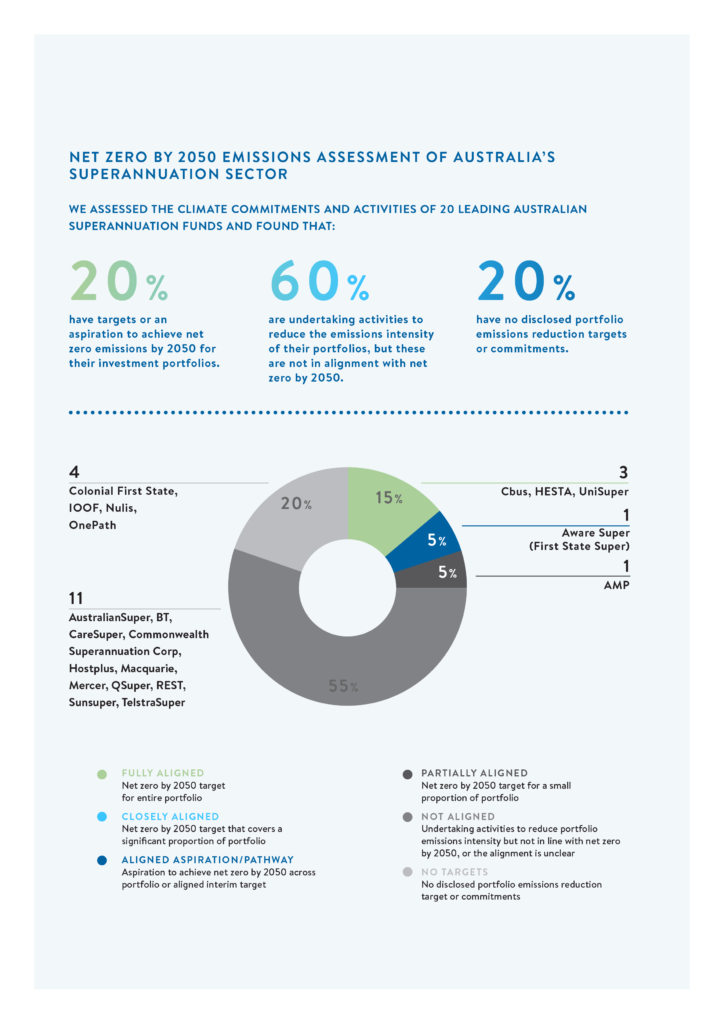

Our analysis found 20 per cent of superfunds assessed have targets, or have expressed an aspiration, to achieve net zero emissions by 2050 for their investment portfolios, of which:

- Three (Cbus, HESTA and UniSuper) have committed to achieve net zero by 2050 across their entire portfolio.

- One (Aware Super, formerly First State Super[1]) has expressed an aspiration to transition its portfolio towards net zero by 2050.

The analysis found the majority – 12 funds representing 60 per cent of those assessed – are engaged in a range of activities to reduce portfolio emissions intensity, but these are not yet aligned with net zero by 2050. Twenty per cent have no portfolio emissions reduction targets or commitments.

This study highlights the importance of engagement in transitioning portfolios towards net zero. At present, the strategies adopted by most funds are centred on investee engagement rather than the setting of net zero targets. In addition to encouraging greater disclosure from the companies in which they invest, some funds now ask the biggest emitters in their portfolios to align their strategies with the goals of the Paris Agreement through initiatives such as Climate Action 100+. Further, more funds are increasing their investments in clean energy; more are divesting from fossil fuels (Mazengarb 2019; Zhou 2019). From 2020, for instance, both HESTA and Aware Super started divesting from thermal coal companies as part of their longer-term targets to reduce emissions within their portfolios (First State Super 2020; HESTA 2020).

In the past few months, several Australian superfunds have announced important commitments to reduce emissions across their whole portfolios.

In June 2020, HESTA made a commitment to reduce emissions funded through its investment portfolio by 33 per cent by 2030, and to net zero by 2050 (HESTA 2020). In August, Cbus gave a similar commitment (Cbus 2020a) and in September, UniSuper followed suit, committing to achieve net zero absolute carbon emissions in its investment portfolio by 2050 (UniSuper 2020). These announcements align with the benchmark established by the Net-Zero Asset Owner Alliance, the members of which have committed to transition their investment portfolios to net zero by 2050 and are now working on methodologies and strategies that can achieve such an outcome (NZAOA 2020; PRI 2020b).

The superannuation funds that have pledged to reach net zero by 2050 across their entire portfolios have set an important precedent. Achieving net zero emissions for the super sector depends on more Australian funds following this lead.

[1] First State Super changed their brand to Aware Super in September 2020.

Context

Australia has one of the largest pension (superannuation) markets in the world (Tang 2020; Willis Towers Watson 2020). As such, it comprises an influential component of the Australian economy. In March 2020, 180 superfunds were managing assets with a pooled value of $2.7 trillion (APRA 2020a, 2020b, ASFA 2020). This figure amounts to one and a half times Australia’s GDP, and could grow to $5 trillion or more by 2030 (Mather 2020). In 2018, superannuation funds owned almost half of Australia’s shares (Davis 2019). It is anticipated they will collectively own up to 60 per cent of ASX-listed equity by 2040 (Deloitte 2019).

A significant proportion of superannuation investments support Australia’s largest companies, including big corporate emitters, yet many superfunds are also proactively investing in green technologies and initiatives (Grieve 2020). This contradictory dynamic makes the sector an important stakeholder in Australia’s transition to a net zero economy.

Australian superannuation funds – and institutional investors more broadly – increasingly recognise the likely impacts of climate change. The sentiment has been fostered by an acknowledgement of the commercial implications of the physical, transitional and litigation risks of global warming, coupled with rising expectations related to disclosure of these risks (IGCC 2020; KPMG 2020; RIAA 2019).

Physical risks arise from more frequent and extreme weather events that devalue assets such as property and infrastructure. Transitional risks are incurred through ongoing investment in fossil fuel dependent sectors, since these face asset devaluations and increased business costs as the global economy shifts to net zero emissions (KnowledgeBank 2020). Litigation risks related to climate change have grown in recent years, with legal cases in Australia nearly as frequent as those in the United States (Peel 2020). Indeed, a landmark case, brought against an Australian superannuation fund by a customer claiming the fund is failing to protect his retirement savings from the financial implications of climate change, could set a worldwide precedent for how pension funds manage climate change-related financial risks (Khadem 2020).

Pressure continues to grow from shareholders (ACCR 2019) and regulators for institutional investors to identify and disclose these different risks, through frameworks such as the Taskforce on Climate-related Financial Disclosures (TCFD). Within the last 12 months, both the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA) have issued guidance for organisations encouraging the use of the TCFD’s framework to disclose how they are evaluating and responding to climate-related risks and opportunities (APRA 2020c; ASIC 2019; KPMG 2020).

To reduce exposure to climate-related risks, some Australian financial institutions are divesting from fossil fuel companies, particularly those that produce or use thermal coal. Many institutional investors are focusing on engagement with the companies they invest in: primarily to seek greater disclosure, but more recently, to encourage decarbonisation (Jones 2020a; Regnan 2019).

Thirteen of the funds featured in this report (AustralianSuper, AMP, Aware Super, BT, CareSuper, Cbus, HESTA, Macquarie, Mercer, QSuper, Sunsuper, TelstraSuper, UniSuper) are signatories to Climate Action 100+, an investor initiative that advocates for engagement with ‘the world’s largest corporate greenhouse gas emitters’ to encourage them to ‘take necessary action on climate change’ (Climate Action 100+ 2020a). This includes commitments from boards and senior management to reduce greenhouse gas emissions across their value chain, in line with the goals of the Paris Agreement.

Ten of the superfunds we have analysed (AustralianSuper, Aware Super, CareSuper, Cbus, HESTA, Hostplus, QSuper, REST, TelstraSuper, UniSuper) are members of the Australian Council of Superannuation Investors (ACSI 2020). ACSI engages with companies on behalf of its members to influence their ESG performance. Such engagement includes encouraging companies to identify climate risks and disclose the strategy, metrics and targets they use to manage them through frameworks such as the TCFD. This, ACSI says, facilitates an acceleration of change ‘by pushing companies towards best practice reporting and management of climate risk’ – and, in some cases, can entail setting emissions reduction and efficiency targets for short- and medium-term timeframes, with the view of achieving net zero emissions by 2050.

Members of the UN-convened Net-Zero Asset Owner Alliance, which include some of the world’s largest pension funds and insurers, have set an important precedent by committing to transition their investment portfolios to net zero by 2050 through their work with corporates, asset managers and policy makers (PRI 2020b). In August 2020, Cbus became the first Australian financial institution to join this alliance.

The challenges experienced by Australians in 2019 and 2020 – droughts, floods, fires and the COVID-19 pandemic – are likely to transform the Australian economy in ways that will necessarily affect the superannuation sector. Market shocks, reduced contributions associated with rising unemployment, and the release of funds to those in need (as per new government policy) will likely result in funds losing value and may foster greater industry consolidation through fund mergers (KPMG 2020).

Expectations that the economic repercussions of the pandemic would derail investor climate change actions and commitments have, however, so far proved largely unfounded. Internationally, there are even signs that fall-out from the virus has galvanised investor resolve to appropriately mitigate the even greater potential economic impacts of climate change (Tigues 2020). For instance, the Institutional Investors Group on Climate Change (including its regional members, the Asia Investor Group on Climate Change, Ceres, and the Investor Group on Climate Change), CDP, the Principles for Responsible Investment and the UNEP Finance Initiative have signed a statement sent to G20 countries and New Zealand encouraging global governments to factor climate change risk into economic recovery plans (Investor Agenda 2020a).

In the wake of the COVID-19 outbreak, some Australian superannuation funds have continued to raise the ambition of their climate commitments. In June, HESTA became Australia’s first superannuation fund to set a portfolio-wide target of net zero by 2050 (HESTA 2020). The following month, Aware Super committed to reduce emissions in its listed equities portfolio by at least 30 per cent by 2023 and advocate for an economy-wide 45 per cent reduction in greenhouse gas emissions by 2030 (First State Super 2020). In August, Cbus announced a net zero by 2050 portfolio target, supported by a commitment to reduce portfolio emissions by 45 per cent by 2030 (Cbus 2020a). In September, UniSuper followed suit, committing to achieve net zero absolute carbon emissions in its investment portfolio by 2050 (UniSuper 2020).

Superannuation funds are also among other influential Australian finance and industry sector representatives calling for the federal government to commit to a net zero by 2050 target and to invest sustainably to stimulate post pandemic economic recovery (Foley 2020; Jones 2020b; Morton 2020; Pupazzoni 2020). AustralianSuper is the Investor Representative for Climate Action 100+ for Australia and New Zealand (Climate Action 100+ 2020b), and a founding partner of the Australian Industry Energy Transition Initiative, working directly with companies to reduce supply chain emissions in hard-to-abate sectors (Climateworks Australia 2020).

Analysis

The Net Zero Momentum Tracker assessed the pledges, commitments and activities of 20 Australian superannuation organisations to evaluate their degree of alignment with achieving net zero emissions by 2050.

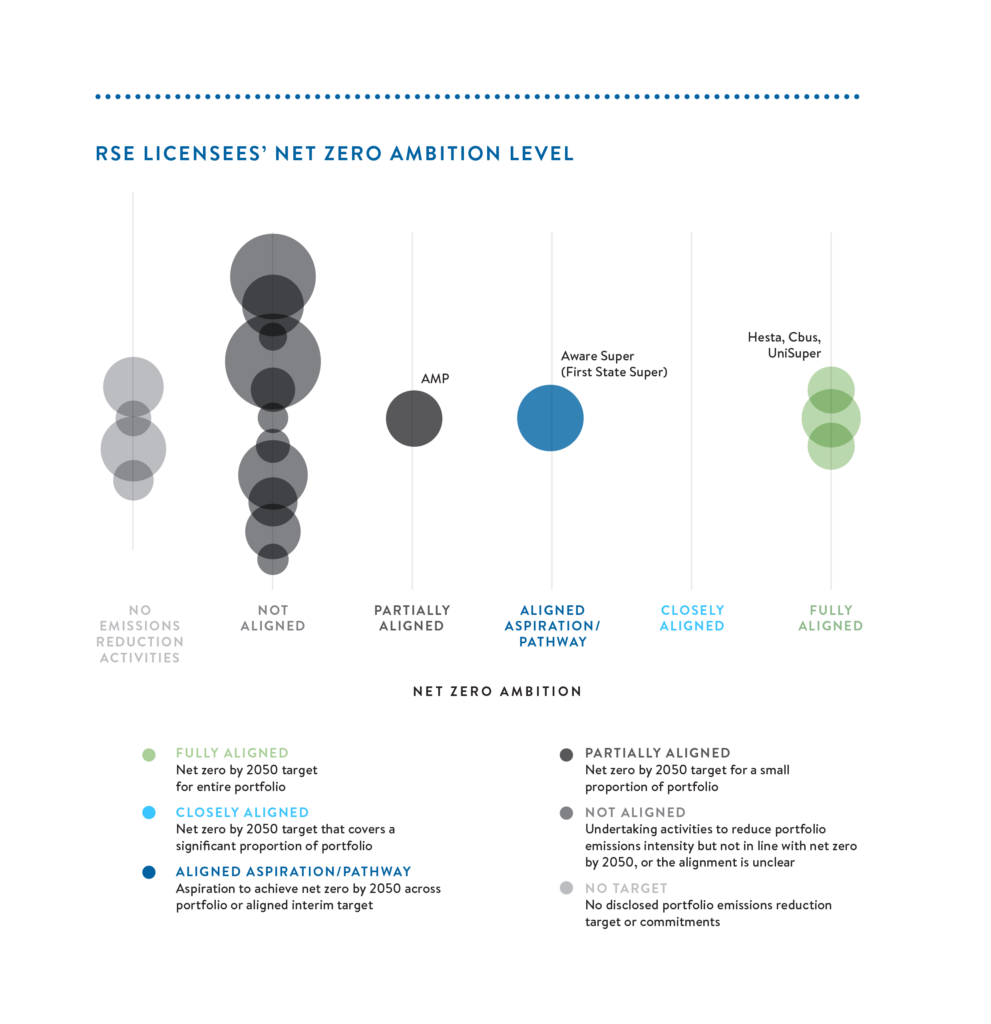

The analysis focused on the largest 20 Registrable Superannuation Entity Licensees, based on the value of assets under management (APRA 2019) (Figure 1).

The results of our analysis and sources used are provided in the Commitments Table, including:

- Each superannuation organisation’s net zero ambition, based on the pledges, commitments and activities that address emissions associated with each fund’s investment activities – the material emissions for this sector. These emissions are often referred to as portfolio or financed emissions.

- The results from a more granular assessment of each organisation’s portfolio emissions intensity reduction activities and initiatives under six asset classes. These asset classes are: equities (shares in listed companies), private equity, fixed interest, infrastructure, property and agriculture and forestry. The activities considered by the assessment include: decarbonisation commitments addressing specific asset classes (net zero property portfolio commitments for example); investments in low carbon technologies and initiatives; divestment; and investee engagement. Engagement activities are acknowledged as aimed at reducing portfolio emissions intensity when this is explicitly stated. They are not evaluated as equivalent to setting a portfolio or asset class-wide net zero or interim emissions reduction target, as they are usually focused on a small number of companies or assets within an asset class.

Additional detail on the analysis approach is provided on the Methodology page.

Of the 20 superannuation organisations assessed:

- Three (Cbus, HESTA and UniSuper) have commitments targeting portfolio emissions that are ‘fully aligned’ to net zero by 2050. Cbus is targeting net zero portfolio emissions by 2050 via a 45 per cent reduction in portfolio emissions by 2030. HESTA has committed to develop a Climate Change Transition Plan that will reduce its portfolio carbon emissions by one-third by 2030, and to net zero by 2050. UniSuper is committed to achieve net zero absolute carbon emissions in its investment portfolio by 2050, supported by interim goals and strategies.

- One (Aware Super) has expressed an aligned aspiration – to ‘seek to transition towards achieving net zero emissions by 2050’.

- One (AMP) is partially aligned, since it has a net zero by 2030 target for its property portfolio.

- Eleven funds have made commitments or are undertaking activities that will reduce portfolio emissions intensity, but these are not aligned with net zero by 2050.

- Four funds have made generic expressions of acknowledgement or intent regarding climate change, but have no commitments or initiatives that will reduce the emissions intensity of their portfolios.

FIGURE 1: Distribution of superannuation organisations assessed by net zero ambition – where the bubble size is proportional to assets under management.

View commitments

Next steps

‘The reality is that things are coalescing fast around us. We have the reality that all states and territories in Australia have made commitments, for instance.’

That was how chief investment officer Kristian Fok described the context for Cbus’ new commitments (Butler 2020). His comments highlighted the sector’s growing awareness of the emissions funded through their investments – and the risks associated with those emissions. As a result, many funds have become increasingly proactive about the decarbonisation of their portfolios.

In 2020, the ambition of climate action in the sector has risen considerably, with three of Australia’s largest superannuation funds (Cbus, HESTA and UniSuper) committing to transition their portfolios to net zero by 2050. Cbus has also become the first Australian financial institution to join the Net-Zero Asset Owner Alliance, an international coalition of institutional investors seeking to achieve the global transition to net zero.

Full sectoral alignment to net zero by 2050 depends on other funds following these examples – that is, setting their own portfolio wide net-zero-by-2050 targets.

It should be noted that the methods by which investors will achieve their targets remains to be defined. That lack of clarity presents a significant barrier for funds hesitating about making their own commitments to a net zero portfolio target.

In response, the Net-Zero Asset Owner Alliance (NZAOA 2020) has outlined methodologies and tools needed to support net zero portfolio target setting and realisation. These are being refined through work such as the Science Based Targets methodologies for financial institutions (SBTi 2020), the EU taxonomy for sustainable activities (TEG 2019) and Network for Greening the Finance System’s (NGFS) climate scenarios (NGFS 2020).

Through such activities, the members of the Net-Zero Asset Owner Alliance are providing leadership for the transition and defining the terms on which it takes place. But that leadership rests on their own commitment to transition their portfolios to net zero by 2050.

More than half of the superannuation funds considered in this report are pursuing emissions reductions through engagement with investees via initiatives such as Climate Action 100+. In addition to involvement in this initiative, the superannuation funds we assessed to be ‘fully aligned’ with the goals of the Paris Agreement have pledged to reach net zero by 2050 across their entire investment portfolios, setting an important precedent for the sector. Achieving net zero emissions for the super sector depends on more Australian funds following this example.

In other words, by setting targets now, superfunds create the context in which their commitments become realisable. By normalising net zero pledges, they bolster the expectation those pledges will be kept and spur the development of methods for sectoral decarbonisation.